Order your copy today!

Publication Date: October 15, 2022Available as Book, eBook, and Audio Book. Choices available on the order page:

Praise for Land is a Big Deal by Lars A. Doucet

Inspiring a renewal of interest in Georgist ideas whose full ramifications are yet to be determined.

Lars's work is intellectually fascinating and among the clearest and most compelling writing in support of land value taxes that I've seen.

Lars Doucet has thought more deeply about land taxes than anyone I've ever met...and I've met just about everyone.

An absolutely wonderful summary of the economics of Henry George and land value taxes. Comprehensive but accessible, and above all fun!

Why land matters more today than ever… and why economists, urbanists & everyone else need to take Henry George Seriously.

I applaud Lars' attempt to take a LVT seriously by looking at the technical obstacles, including assessment of land. Efforts like his are going to be key in taking this from a great theory to a policy reality.

Take the Georgist pill and read this.

Have you seen the cat? Whether or not Doucet converts you to Georgism, you’ll come away with a new appreciation for how every economic system is built on the same resource: land.

If you've read about Henry George and his book Progress and Poverty, but never actually read them, here is your big chance to learn a lot without reading so many hundreds of pages.

Radical yet practical, utopian yet grounded, old yet new! The idea that, “no, seriously, we should shift the tax burden from producers onto land-monopolists,” started with Adam Smith in the 18th century, fleshed out by Henry George in the 19th century, memory-holed in the 20th century, and now reanimated by Lars Doucet in this 21st century.

But Doucet’s book isn't just a retweet of George's ideas – Doucet rigorously backs up the old ideas with new data & models, and proves to us how this centuries-old idea is more timely than ever!

Synopsis

The conflicts of the last century have trained us to see capital and labor as two fundamentally opposed camps–if we want to stimulate growth and economic progress, it means squeezing workers, and if we want to take care of workers it means accepting higher taxes, more barriers to starting and running a business, and a hit to overall economic growth (or so the conventional wisdom goes).

But what if we've been missing out on a crucial piece of the puzzle, something that flips the entire script?

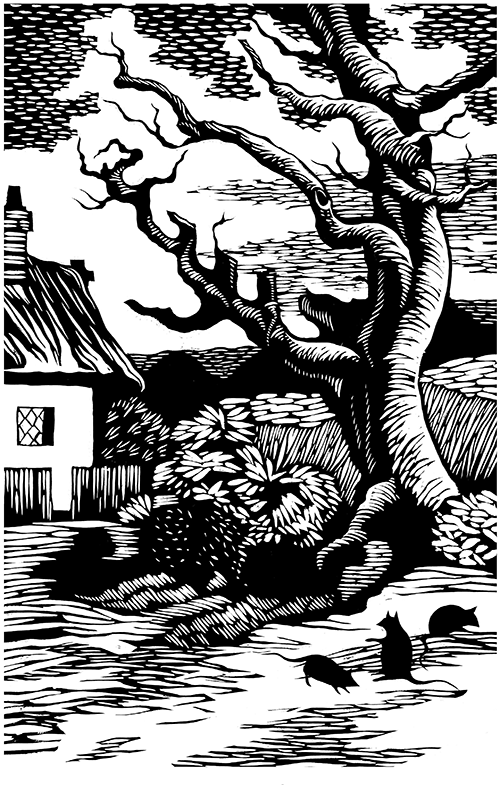

Take a look at this picture:

(Source: Nick Hayes, used with permission)

Do you see the cat?

Nestled in the negative space between the tree’s branches, the cat represents the hidden role of land that shapes the entire economy: once you've seen it, you can't un-see it. Land, and the policies that govern it, hold an incredible and largely forgotten power over our lives. When land is wasted and squandered, we get sky-high rents, oppressed workers, ruined businesses, depleted natural resources, a polluted earth, and an impoverished society.

Land is a big deal, and this book will explain the problem and what we can do to solve it.

PART I is a review and summary of Progress and Poverty, the seminal text concerning the land problem. That book was the magnum opus of 19th century American political economist and populist firebrand Henry George and was so popular in its time that many have claimed it outsold all other books except the Bible. I explain and contextualize Henry George’s philosophy for modern readers, known today as Georgism or Geoism. Then, I lay out his proposed solution to the land problem, the “Land Value Tax,” a tax on the annual rental value of land, but which excludes the value of all improvements, such as buildings.

Having established the problem and its solution, I then move on to addressing critics. There are three common practical objections that newcomers to George’s philosophy tend to raise: 1) that land just isn’t an important part of the economy anymore, 2) that Land Value Tax will just be passed on to tenants and make everything more expensive, and 3) that even if all the theory is correct, unimproved land can’t be accurately assessed in practice, so the whole project is doomed.

The next three parts address each of these objections in turn.

PART II empirically establishes that land is a big deal, not just in the 19th century, but even and especially today. First, I demonstrate that the chief component of sky-high urban real estate prices is due to land values, not buildings. Second, I collect and synthesize all the best estimates of America's total land values and demonstrate how a tax on the annual rental value of land could raise enormous sums of revenue sufficient to significantly offset or even replace existing sales, income, and capital taxes. Finally, I show the degree to which real estate has come to dominate bank lending, how housing has become the largest asset class in the world, and the degree to which landownership is concentrated among the wealthy.

PART III lays out the empirical case for Land Value Tax not being passed on to tenants. I explain the theoretical basis for this and then provide empirical evidence showing the effects of Land Value Tax policies in the real world. Counter to what is often claimed, I demonstrate that landlords not only can't, but empirically don't, simply pass on the tax to their tenants by raising rents.

PART IV evaluates the available methodology and current state of practice for assessing unimproved land values separately from buildings. I give an overview of established best practices, critique the status quo where it falls short, and present a sampling of the latest methods from the research literature that can improve upon the state of the art.

PART V concludes by reviewing all the evidence and practical case studies we've seen so far and charts a path forward for the work that lies ahead.

Details

This book has its origin in a series of guest articles posted on the website Astral Codex Ten. The first of these was a book review of Progress & Poverty, which won first place in the site's book review contest. The site's audience was intrigued by the idea and asked for some follow-ups evaluating the empirical claims of Georgism, which resulted in the three-part series, "Does Georgism Work?" The entire series was eventually collected and re-posted on the standalone site Game of Rent. These have now been edited and collected into this book, Land is a Big Deal, published by Shack Simple Press.

Here are a few key findings.

Economists across the political spectrum are in near-universal agreement about one thing: Land Value Tax is the best tax there is. Nobody creates land, but everybody needs it, and there is fierce competition for good locations in populous city centers. The general problem with taxes is that when you tax something, you get less of it. So if you tax income, you get less labor. If you tax capital, you get less investment. If you tax buildings, you get less buildings. But if you tax land, you don't get any less land. (A land value tax shouldn't be confused with a property tax, which taxes land and the buildings that sit upon it; land value tax only taxes the land).

In fact, not taxing land is a perfect recipe for speculation and ever-inflating housing prices, which infect the rest of the economy and contribute to higher costs of living and general stagnation. Land Value Tax discourages people from buying land just to hold it out of use. Instead, it encourages denser building, which has been repeatedly shown to be better for both quality of life and for the environment. Land Value Tax is a rare tax that instead of being a "necessary evil" that puts a drag on the economy, actually boosts it. Even better, every dollar raised by Land Value Tax is a dollar we can reduce other less efficient taxes (such as those on personal incomes) by.

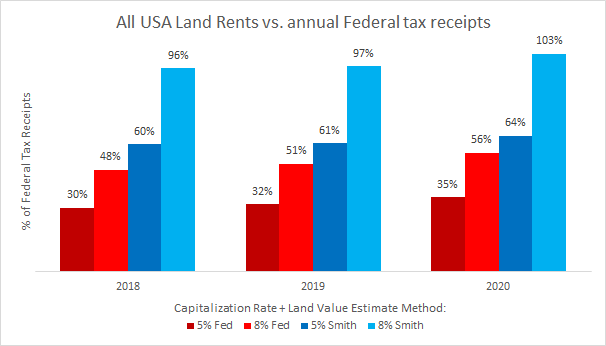

So how much can Land Value Tax raise?

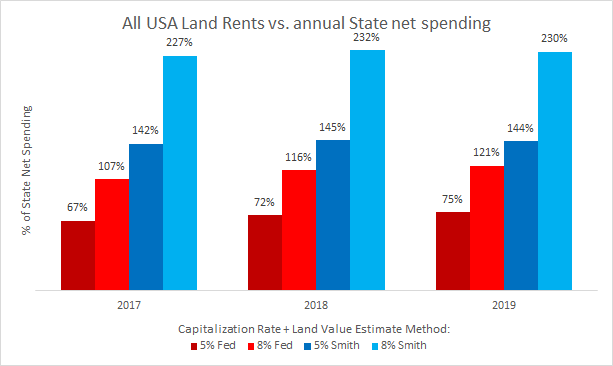

Conservative estimates indicate a Land Value Tax could raise an amount equal to 30-100% of all federal tax receipts:

Source: Land is a Big Deal

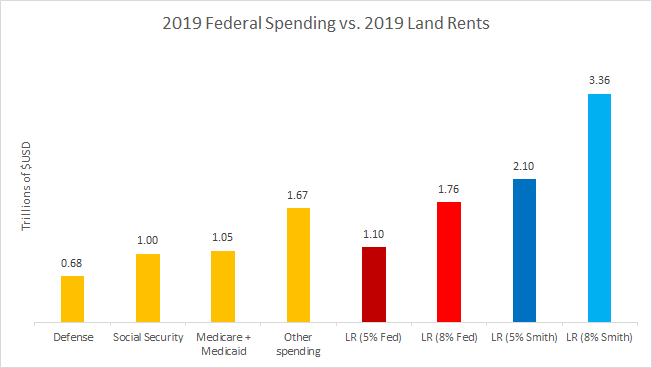

Put another way, on the low end that's enough to fully fund any ONE of our three major non-discretionary spending obligations: social security, healthcare, or the defense budget. On the higher end, a Land Value Tax could fully fund all three, with money left over to spare:

Source: Land is a Big Deal

If LVT is levied only at the state level, even the most pessimistic estimates would cover the majority of current state spending levels:

Source: Land is a Big Deal

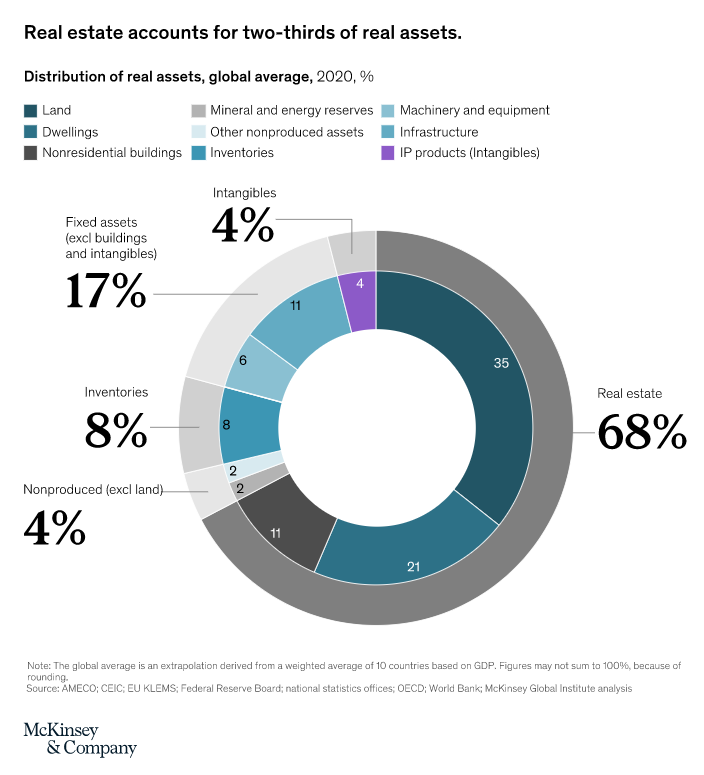

This is because Land is a Big Deal. It's no coincidence that real estate is the world's single largest asset class:

Source: McKinsey & Company

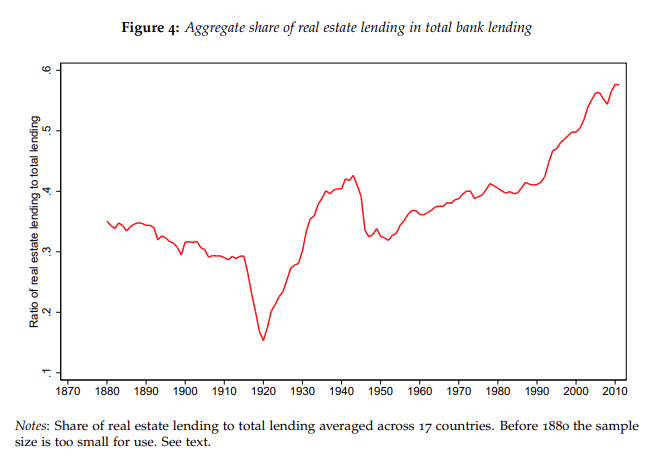

...or that real estate comprises an ever-increasing majority share of bank loans:

Source: Jordà, Schularick, and Taylor

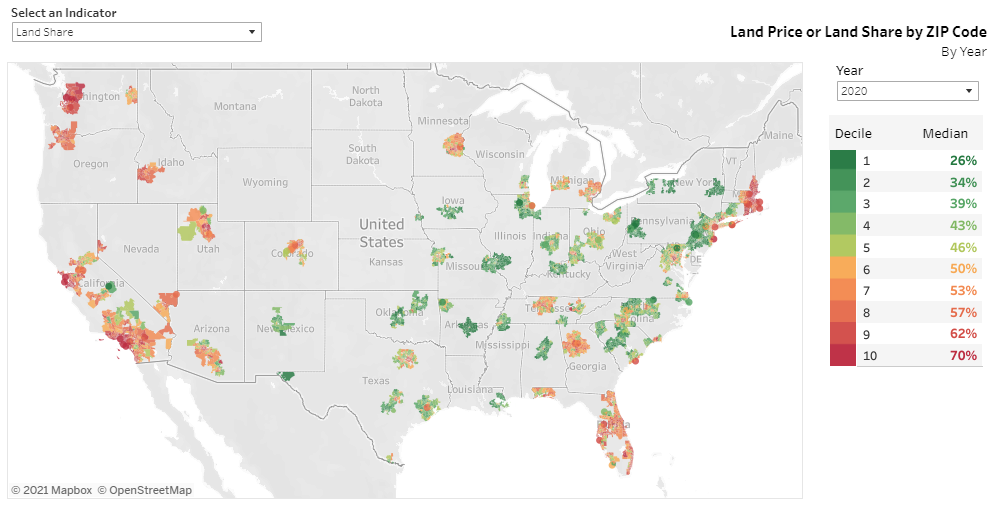

And of course, the vast majority of that real estate's value is due to land:

Source: American Enterprise Institute

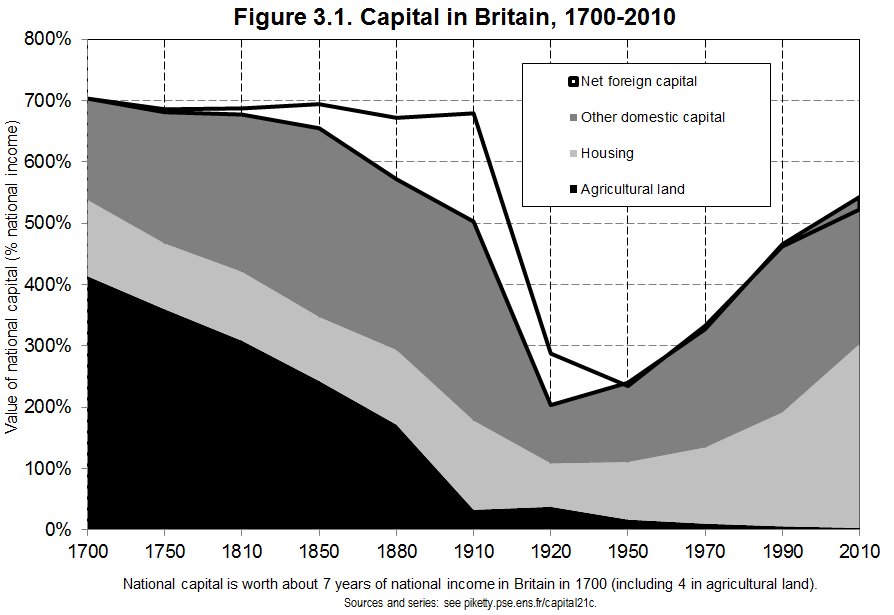

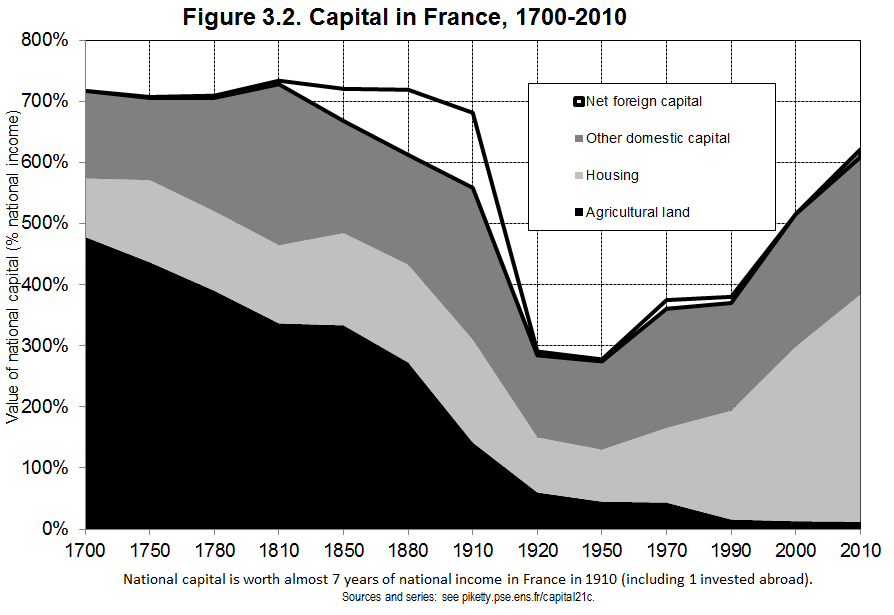

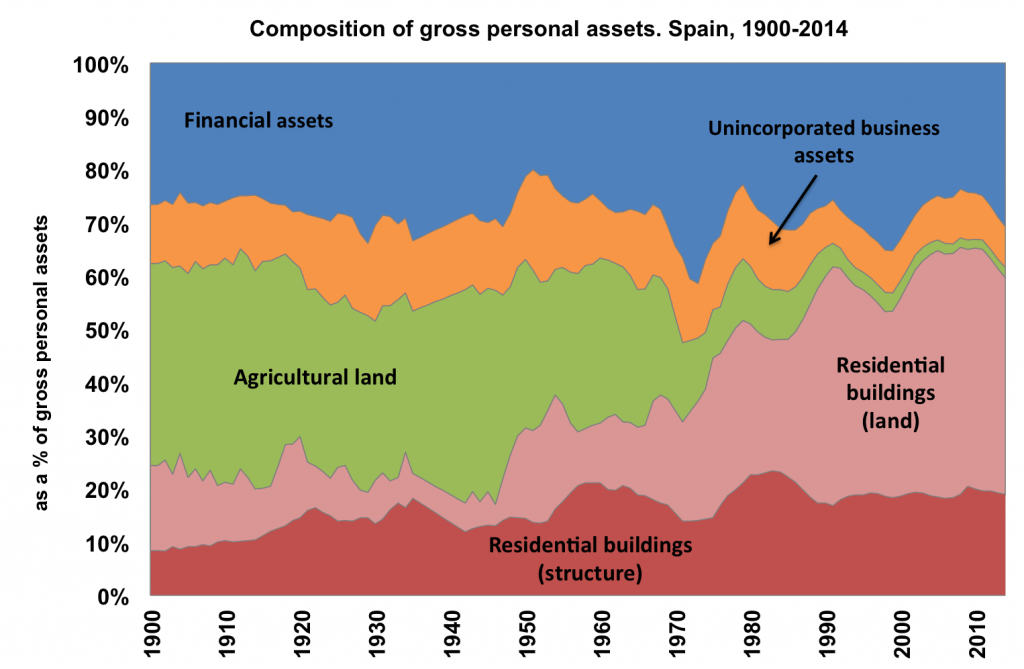

The power that aristocrats once wielded from controlling agricultural land has shifted to those who own residential land:

Source: Capital in the 21st Century by Thomas Piketty

Source: Capital in the 21st Century by Thomas Piketty

Source: Blanco, Bauluz, & Martínes-Toledano

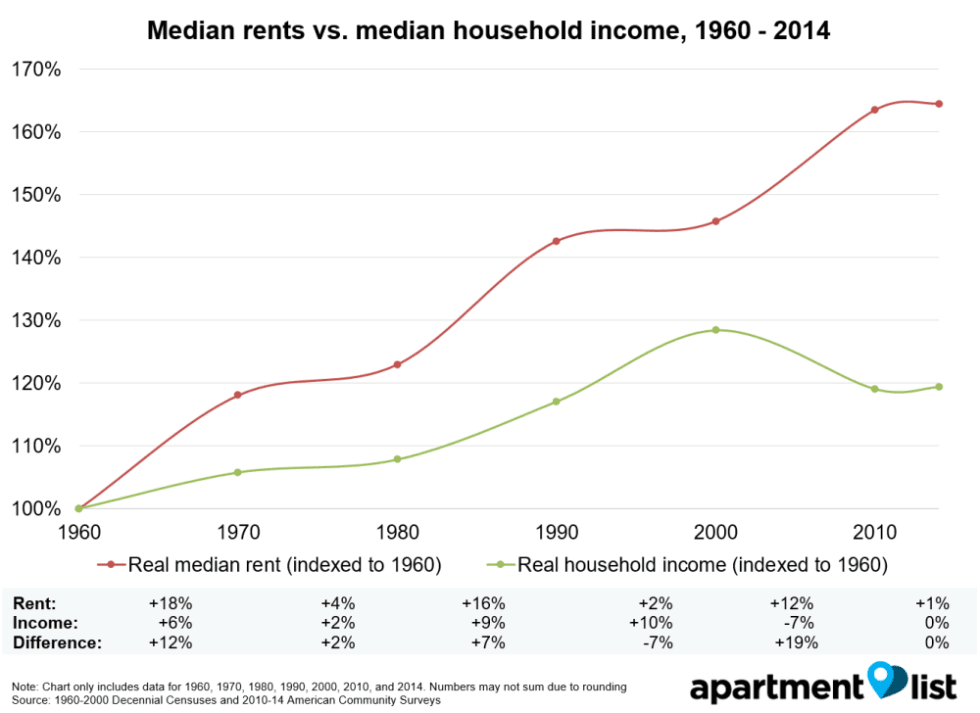

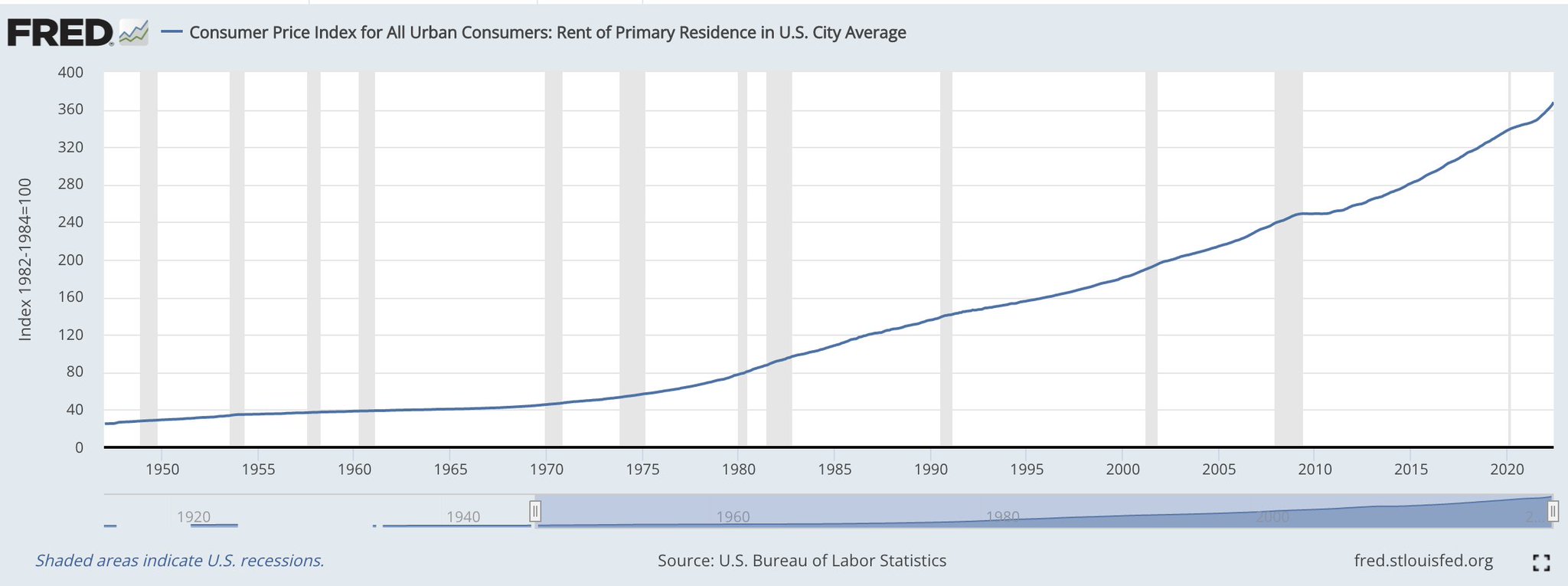

This has had predictable effects on housing prices and rent:

Source: Apartment List

Source: FRED

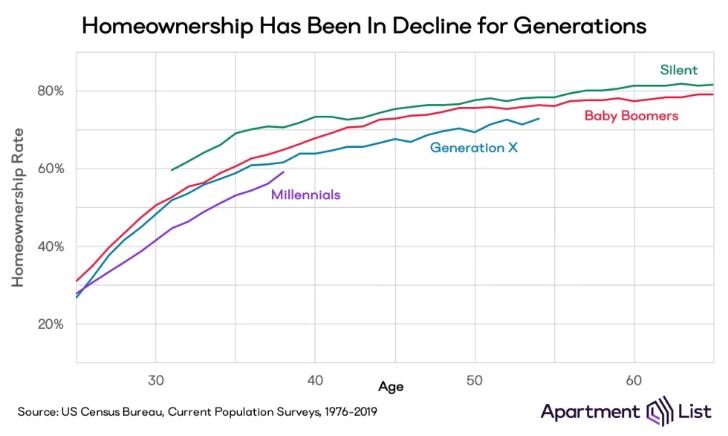

Not to mention successively declining rates of generational home-ownership:

Source: Apartment List

Land is a big deal. This book talks about why that's a problem, how things got this way, and what we can do about it.

Order the book now!

Publication Date: October 15, 2022Available as Book, eBook, and Audio Book. Choices available on the order page:

Contact

You can email the author at: lars.doucet@gmail.com